Excess reportable income doesn’t impact many investors

Excess reportable income doesn’t affect every single investor – only those with interests in offshore funds outside of an ISA or a SIPP. However, with the popularity of managed portfolio services (MPS) on the rise, UK investors are more and more likely to have a holding in an offshore fund.

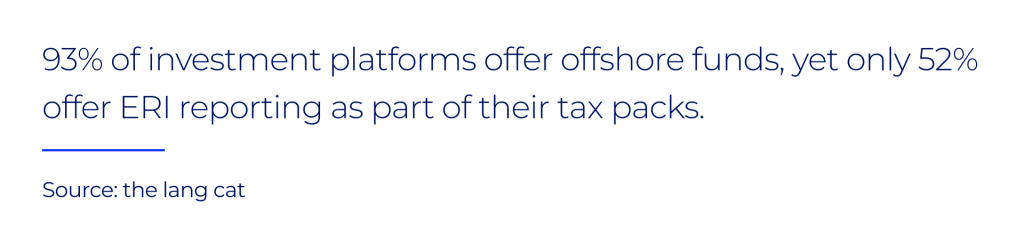

According to research by the Lang Cat, nearly three quarters of the MPS ranges on their Analyser software contain offshore funds. This means there’s a high likelihood that an investor holding one of these investments would need to report ERI information to HMRC. Unfortunately, finding accurate and up-to-date ERI information often isn’t easy for investors or their wealth managers.

Funds aren’t required to provide ERI data in a standardised way or ensure that it is easily accessible. As a result, sourcing ERI information can be a frustrating and laborious process, even for an experienced wealth management team.

Nonetheless, the stakes for not providing this information or getting it wrong are high. If ERI information is missing or recorded incorrectly on a tax return, an investor can be fined up to 200% of the tax due, plus interest and potential late payment penalties.

HMRC is also clamping down on unreported offshore interests and investment. According to a report by the Financial Times, the UK tax authority sent nearly 24,000 nudge letters in the 2022/23 tax year, up 31% on the previous year, as part of their effort to crack down on tax avoidance.

At Raw Knowledge, we do the heavy lifting of sourcing hard-to-find offshore funds data to make ERI reporting easier for wealth managers, financial advisers and their clients.

We provide firms with a full data set for tax reporting, including fields rarely provided on a fund manager’s original documentation such as equalisation rates and the identification of asset breakdowns. By doing so, we help investors avoid hefty penalties, protect against reputational risks for businesses and ensure they better meet stringent consumer duty standards.

All offshore funds will report tax in the same way

Offshore funds can either be ‘reporting’ or ‘non-reporting’ in the eyes of HMRC. If an offshore fund has HMRC-approved reporting status, they have agreed to comply with several rules, such as the requirement to have an independent audit and report a calculation of reportable income annually.

These requirements by HMRC bring the offshore fund more closely in line with the rules for UK funds. It also changes the way the fund is taxed.

When an investor sells a position in a non-reporting fund, HMRC will assume all income has not been taxed within the investment and will charge the profit on sale at the investor’s marginal income tax rate.

Reporting funds are different. They need to publish an excess reportable income rate for all the income recorded in the fund, confirming the amount that would have been paid if the fund had paid out. This undistributed income must be calculated each year, and investors must pay income tax as if they had received it. When they sell their fund units, any gains are taxed as capital gains.

In theory, reporting funds should publish the ERI rate for all the income recorded in the fund annually. However, investment funds aren’t required to provide ERI data in a standardised way, and it isn’t always accessible or up to date on investment funds’ websites.

As a result, many financial advisers will rely on their platform providers for the ERI information and relay this to their clients, but platform data is only likely to be as good as the data given to them by offshore fund managers and this can be challenging to interpret and reconcile.

Research conducted by our sister company, Financial Software Ltd, in collaboration with the Lang Cat, found that 93% of investment platforms offer offshore funds, yet only 52% offer ERI reporting as part of their tax packs.

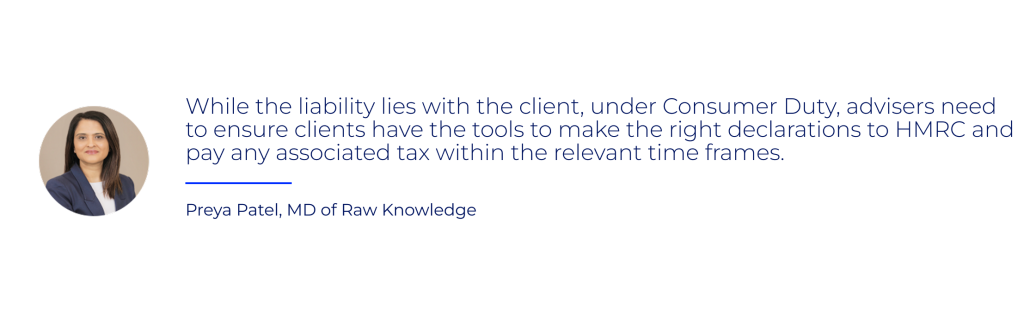

At Raw Knowledge, we believe that we should all be committed to providing the right details to investors and that failing to do so could be seen as falling short of Consumer Duty responsibilities.

Though the onus is ultimately on the investor to provide the right information on their tax return if they invest in offshore funds, by ensuring that your firm has accurate, up-to-date offshore fund information, you can help your clients avoid hefty penalties and protect against reputational risks for your business.

Outsourcing your ERI data provision to a third party like us can mitigate any risks of incomplete or inaccurate data, streamline your tax reporting and help you secure a competitive advantage over industry peers.

If an offshore reporting fund didn’t pay income, there’s no ERI to report

If there is a non-zero ERI rate, then an investor will have to pay ERI to HMRC.

A fund’s ERI figure is calculated by taking its gross income received and subtracting any expenses and income paid. The amount owed can be worked out by multiplying the fund’s ERI figure by the number of shares an investor held at the end of the last day of the fund’s reporting period.

It is important to remember that what one jurisdiction calls income and expenses is not necessarily the same thing as under the UK reporting fund regime. This means that it is possible to see an incredibly low ERI rate for a fund because, according to its governing country’s law, it has paid all its income but, according to UK law, it hasn’t.

As a result, an investor could be left with an ERI rate of 0.00001 per share which, though small, would still need to be paid and reported on a UK tax return.

Further, even if a fund has paid cash out to investors, if it publishes a document saying there is ERI on top of that then a UK investor will have to report both the cash paid and the ERI on their tax return.

At Raw Knowledge, we make reporting ERI easier by arming the financial services industry with high-quality, accurate data and helping them determine their clients’ tax liabilities. We’ve been handling ERI data since the very start of the offshore reporting funds regime and serve a diverse range of UK and international clients, so we understand your pain points and can support any data or tax queries you may have. We’re also committed to transparency so provide you with the original source material, upon request, so you can have complete confidence that your reporting will be accurate.