The content contained in this article is for information purposes only and does not constitute as financial or investment advice. If you are unsure of the treatment of a transaction, we encourage you to seek the appropriate advice.

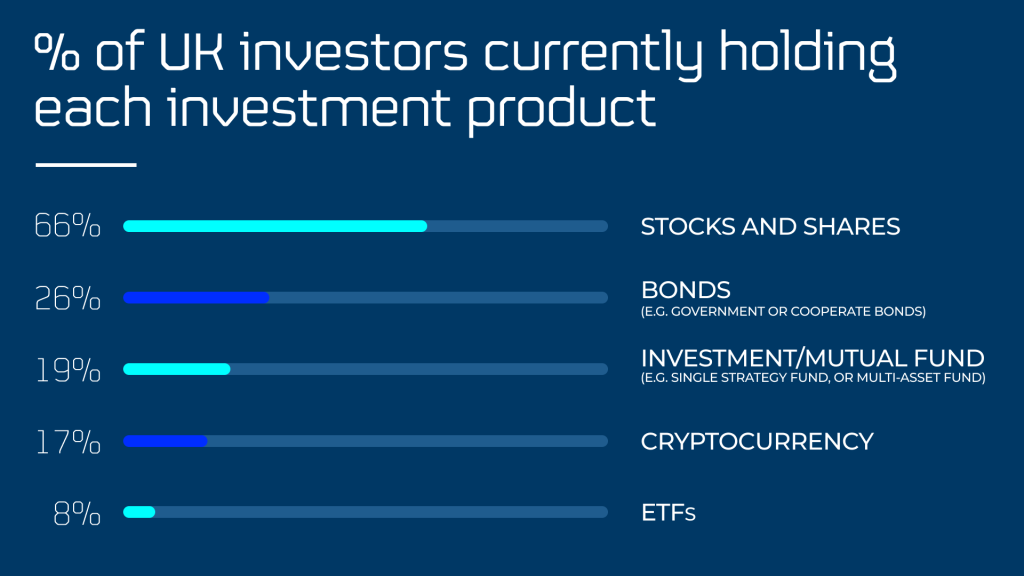

While stocks and shares remain the most widely held investment product in the UK, exchange-traded funds (ETFs) are rapidly growing in popularity amongst investors.

Investors around the globe poured $1.7 trillion into ETFs in 2024, according to The Financial Times, pushing the industry’s total assets up 30% compared with the previous year. The US has been at the centre of this rush of new cash, notching up inflows of more than $1 trillion, but the UK has also been a fertile market for the product.

According to a recent report by BlackRock, ETFs are now held by 8% of UK investors. This figure is up 57% since 2022, making ETFs the fastest-growing investment product in the UK and making the UK the third largest market in Europe by volume of investors.

The interest in ETFs is also showing no sign of slowing down. BlackRock’s 2024 report found that, among UK investors not currently holding ETFs, 2.4% say they are “very likely” to invest in the product in the next year. This would translate into around 1.3 million potential new ETF investors in the UK.

What is an ETF?

An ETF is a type of investment fund that holds a basket of securities like stocks or bonds. The main difference between an ETF and other types of investment funds is that ETFs can be bought and sold like an individual stock on a stock exchange. This means that, unlike with traditional mutual funds, investors can invest any time the stock market is open and will see the price of their ETF fluctuate throughout the day.

It must be noted, however, that the price of an ETF on a stock exchange typically tracks its net asset value (NAV) rather than the supply and demand of the ETF itself. They can also be traded back with the fund manager in the same way as other funds.

ETFs can be designed to track specific investment strategies and offer exposure to a variety of asset classes including equities, currencies and commodities. They can be either ‘passive’ or ‘active’. Passive ETFs usually track a benchmark index like the FTSE 100 or S&P 500 and aim to replicate its performance, regardless of whether the index takes a turn for the worse. In contrast, active ETFs aim to outperform their designated index.

Why have they become so popular?

ETFs are often a cheaper way to invest as they tend to have lower management fees compared to traditional investment funds. Research by Morningstar found the average fee for an ETF is 0.51%, compared to 1.01% for an average mutual fund.

There is also often no minimum investment size for ETFs. This has made the products popular amongst low-income or beginner investors, with BlackRock noting that 18 to 34-year-olds are 80% more likely to hold ETFs than those over 35. 87% of UK ETF investors access funds through an online investment broker, online investment platform, or robo-adviser, which may also contribute to their popularity amongst a younger demographic.

How are ETFs taxed in the UK?

If your investment is outside of a tax-efficient wrapper like an ISA or a SIPP, you will have to pay tax on the profit you make from selling your ETF. However, the type of tax you must pay will depend on where your ETF is domiciled.

The place of domicile

An ETF being listed on a UK exchange is no guarantee that the ETF will ultimately be domiciled in the UK.

Take, for example, the iShares MSCI UK ECITS ETF. The fund seeks to track the performance of an index composed of companies from the UK and is listed on the London Stock Exchange. Despite this, the domicile of the ETF is Ireland.

UK-domiciled ETFs are those that are registered and managed within the UK. These funds are regulated by the UK Financial Conduct Authority (FCA) and are subject to UK tax laws. As a result, if your ETF is domiciled in the UK, the tax you pay will most likely be capital gains tax (CGT) on any profit on the sale of the ETF.

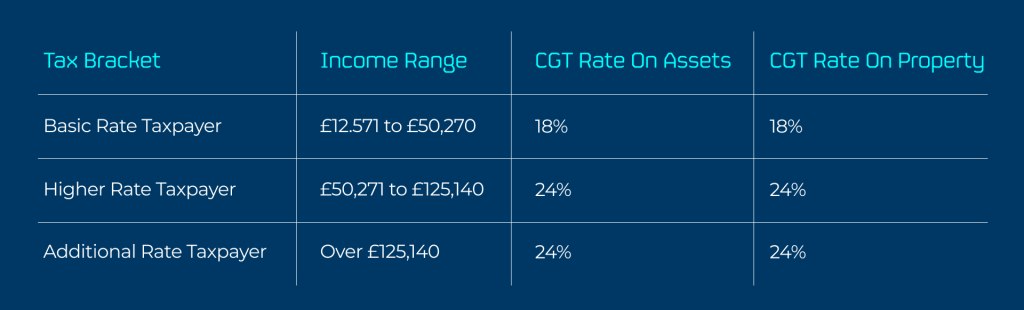

For the 2024/25 tax year, the annual exemption amount is £3,000. Beyond this threshold, the rate of CGT you will pay will depend on your overall income. If you are a basic rate taxpayer, the rate of CGT will be 18%. For higher or additional rate taxpayers, this will be 24%. These rates have applied since 30 October, 2024. Lower rates applied prior to this date.

Things can get trickier, however, if the ETF is domiciled outside of the UK.

Reporting or non-reporting status

If your ETF is not domiciled in the UK, then the tax you pay will depend on whether it has ‘reporting status’ with HMRC.

Overseas-domiciled ETFs fall under the definition of an offshore fund in the eyes of HMRC. Offshore funds have their own set of rules which they must follow, including that the fund must be backed by marketable assets and a requirement that the price an investor can realise for units must be at or close to its NAV.

Offshore funds can apply for reporting status with HMRC if they agree to comply with several rules, like the requirement to have an independent audit and annually report a calculation of reportable income. These requirements bring the offshore fund more closely in line with the rules for UK funds, meaning they can have a similar tax treatment.

This is because reporting funds are required to publish an excess reportable income rate (ERI) for all the income recorded in the fund, confirming the amount that would have been paid if the fund had paid out. This undistributed income is calculated each year, and investors must pay income tax as if they had received it.

When an investor then sells their fund units, they get extra base cost because they’ve already paid tax on the benefit of keeping the income within the fund. As a result, any gains are taxed as capital gains rather than income.

But, when an investor sells a position in a non-reporting fund, HMRC will assume all income within the investment has not been taxed and will charge the profit on the sale at the investor’s marginal income tax rate. This means an investor could pay up to 45% on any gains they make.

Dividends, interest and withholding tax

Dividends and interest distributions earned on UK-domiciled ETF will be subject to income tax. Like with CGT, this will depend on the investor’s tax bracket and will have to be paid regardless of whether the investment physically pays you income or reinvests it.

For overseas-domiciled ETFs, dividends may be subject to withholding tax as well as income tax, regardless of whether they are directly paid out to investors. Withholding tax rates vary depending on the jurisdiction in which the investment is domiciled and any tax treaties between the UK and that jurisdiction.

How do I find accurate ERI information?

Sourcing ERI information by yourself can be a frustrating and laborious process. Funds aren’t required to provide ERI data in a standardised way and the information that is there isn’t always accessible on their website or up to date. At Raw Knowledge, we do the heavy lifting of sourcing hard-to-find offshore funds data.

Our ERI data solution provides you with a full data set for tax reporting, including fields rarely provided on a fund manager’s original documentation such as equalisation rates and the identification of asset breakdowns.

All our data is verified, structured and traceable, with an internal validation process at each stage, so you can have complete confidence that your reporting will be accurate. In the rare cases we don’t have full coverage of your targeted fund universe, our dedicated team are ready to dig deeper and conduct primary research to source the information you’re looking for.